Thrive Perspectives

Horizon scan: The UK Corporate Governance Code gets serious about ESG

the FRC’s (Financial Reporting Council) recently published a consultation paper on proposed changes to the UK Corporate Governance Code. Here are 5 headline (proposed) changes within the Code that directly relate to ESG matters.

Burness Paull partners with Thrive Consulting to expand its ESG advisory offering

Burness Paull has partnered with sustainability consultancy Thrive to expand its ESG advisory offering in response to growing demand from clients.

The ESG regulation acronym buster

The world of ESG loves an acronym and just as you think you have got your head around them all, another one makes an appearance.

This is especially evident when it comes to legislation and ESG reporting. There are differing opinions as to whether the increasing volume of ESG reporting legislation is an effective way to ultimately drive positive change with some arguing that the resulting ‘reporting burden’ takes time away from actually implementing change. On balance however, we see this as good news; each piece of new legislation brings with it guidance (and therefore clarity) on how companies need to approach the societal and environmental risks and opportunities they face.

Boards & ESG: Who exactly is responsible?

There are a number of ‘right’ answers to this question, in fact the only ‘wrong’ answers are ‘I don’t know’... or ‘no one’.

With investors’ laser-focused on ESG, boards must consider and review which ESG oversight model is best suited to the businesses they oversee.

The buck stops with you: A 6 step plan for Board governance of ESG

A recent study by Boston Consulting Group and Insead found that 64% of directors expect institutional investors to put forward new ESG-related proposals at their next annual general meeting but as many as 70% of directors reported that they are only moderately or not at all effective at integrating ESG into company strategy and governance.

What does 2023 have in store for your company’s ESG agenda?

Expectations around the need for focussed, credible ESG strategy and disclosure have increased significantly. We see first hand how transformative it can be for companies to embrace the principles of ESG.

Legislation update: EU Corporate Sustainability Reporting Directive (CSRD)

In November 22, the EU adopted the Corporate Sustainability Directive, designed to drive much clearer, comparable ESG disclosure from companies

The hidden consequences on UK business from US legislation

Will the increased ESG disclosure rules, as proposed by the SEC for the US stock market impact my business here in the UK?

Case study: TelecomPlus PLC X Thrive

Case study: Utility Warehouse X Thrive

ESG Reporting: an opportunity, not a chore

Any company with employees, customers and/or investors should consider their ESG report as a golden opportunity to engage, communicate and build intrinsic value/relationships. You may not HAVE to report but this is changing fast and nobody wants to be a laggard.

Stakeholder Capitalism

Greenwashing 101

According to an EU study 42% of all green claims in European companies marketing materials were exaggerated, false or deceptive.

IPCC report 2021: Key takeaways

On 9 August 2021, the U.N. climate panel released its most comprehensive assessment of climate change yet.

Carbon offsetting: Tread carefully

If we are to stay within the planet’s liveable boundaries, we need to halve global emissions by 2030.

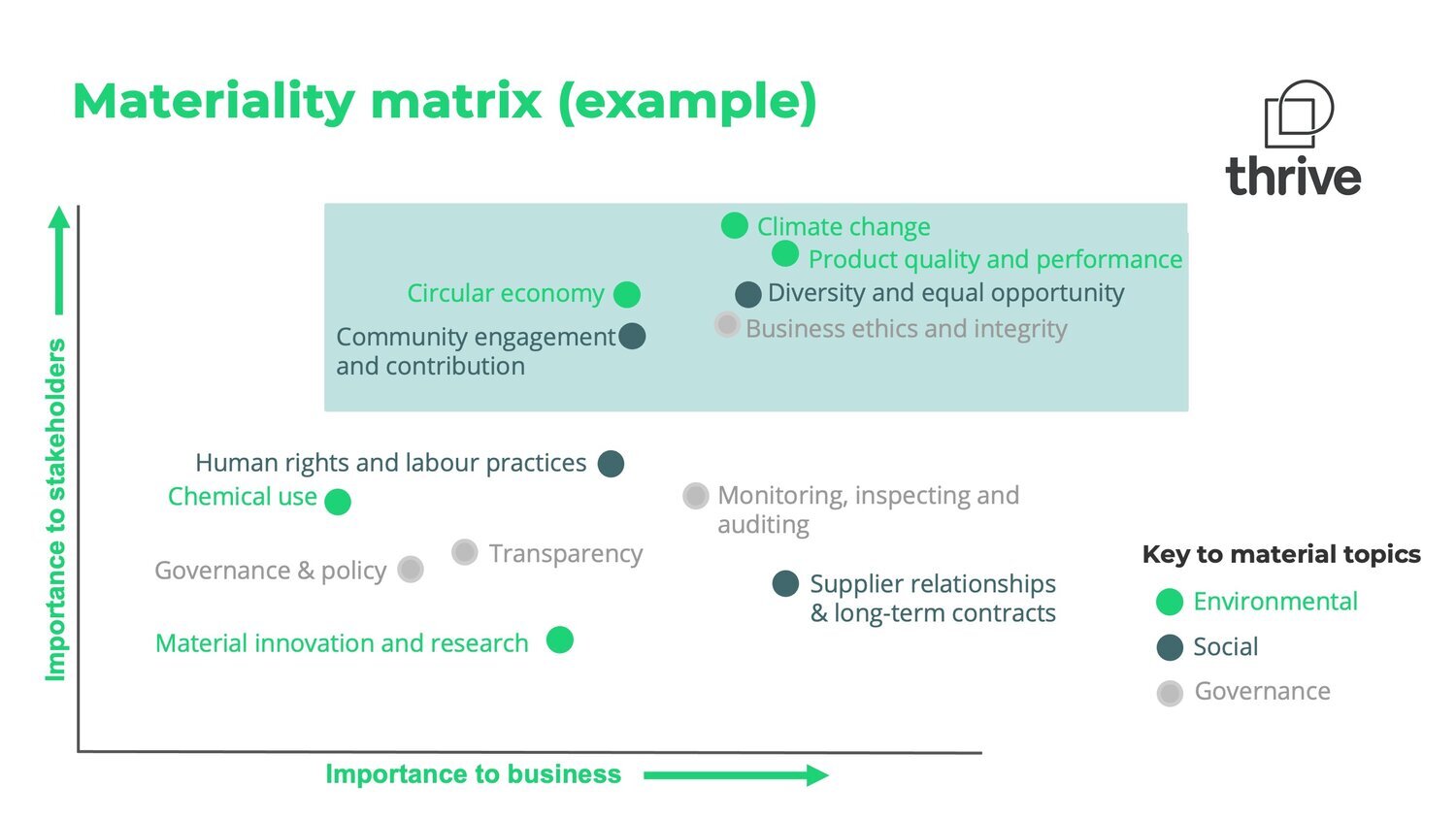

Materiality Assessment: 5 ways this strategic tool delivers real commercial value

Materiality Assessment is essential to any future looking, progressive business, yet it remains a relatively unrecognised and ambiguous concept.

What can we learn from the global leaders in sustainable sportswear?

These industry leaders are committed to transparency and accountability, through clear, ambitious targets and open reporting strategies.

Creating value and business resilience through ESG

Environmental, Social and Governance (ESG) is fast becoming common language in the boardroom and we think it can form an essential part of your leadership rhetoric when building business and gaining the support of your internal and external stakeholders.

Tackling climate risk

Five steps to unlock the value of the circular economy

If there’s such a clear economic and environmental case to shift strategy, mindset and operations, what’s stopping so many companies from embracing a transformation?